Deciding to enter the residential land development market comes with its fair share of challenges with your first hurdle to overcome is finding a solid piece of land to develop on and then to develop it. A good plan of action, using the open network of specialists who are available to you and understands the ins and outs of the residential market (assuming you are into residential property development) will put you on a sound footing as you take the challenge on and dive into the market.

This is a step by step guide on how to subdivide land. Here are the key 8 steps in the property development process when it’s come to the process of subdividing land.

1. Finding a site

2. Due Diligence and Feasibility

3. Purchasing the Site or Controlling Site Ownership

4. Local Authority and Council Permits for Property Development

5. Project Financing

6. Off-plan Marketing

7. The Development – Land division and building

8. Site Settlement

Let’s have a look at how property developers find sites for land division.

Finding a Site

Generally, ten accepted channels allow residential property developers to find sites for land division.

Let’s visit them one by one.

1. Estate Agents

Regardless of your opinion of estate agents, the big players who have years of knowledge and a solid reputation behind them know what they are doing. Usually, they offer an adequate portfolio of land for sale, which may or may not already is prezoned for land division.

If you are shopping in the market, you should have your development strategies and business plans in place. You should know what you are looking for.

When visiting or inquiring with Estate Agents ensure that you communicate your requirements clearly.

Don’t be afraid to ask the pertinent questions and do your research on surrounding properties or vacant land always questioning what it is earmarked for.

There is however a downfall to using an Estate Agent; they are the most obvious option, and because of that the competition for quality land may be fierce with certain developers taking preference because of previous business deals and if you cannot offer them anything of value in return for their favorable treatment you may find yourself playing second fiddle to those who can.

In other words, real estate agents or relaters bring the ‘left-over’ deals to the market where the real deals were already passed on ‘off-market’.

2. Land Development Agents

Land development agents specialize only on selling lands with development potential.

They are the difference between seeing a general practitioner versus seeing a cardiologist for a heart issue. Both are doctor’s, but one is more qualified in the service you require.

Land development agents take fees from buying and selling sites specifically for development, meaning that they are probably the best source for land that is ripe for development.

They usually have a massive network of people available to them, meaning that taking your business plan to them will almost certainly produce a couple of options for you to view. Unlike real estate agents, they are not interested in wasting time with the frills though, so if you are in the market with the intention to try and negotiate down, then this shouldn’t be your first choice.

These guys are in it to get paid and build sustainable relationships with serious land developers.

3. Online Property Websites

Most of the time these sites work hand in hand with either Estate Agents or Land Development Agents, by setting up notifications to meet your specifications; however, you can save a lot of time and money going from agent to an agent trying to find your ideal land.

Therefore, regardless you are a property developer or investor, you should monitor your local online platforms for good deals.

4. Property Auction

Buying land through an auction is a fantastic option for deal hunters, a lot of the times providing good land for under market value. Having said that, if a deal is too good to be true it is usually; to save yourself the heartache and financial loss at a later stage ensure that you inspect the property thoroughly before bidding on it.

Don’t fall into the excitement of the bid, set a budget and bow out if the property starts to climb above what you initially thought it was worth.

By putting in your offer on the auction site the day before you will have a full list of what is on the market for the next auction. This gives you time to do your homework, view the property and formulate an estimate of what you believe the property is worth meaning that you have the upper hand. Just don’t forget to withdraw your offer before closing.

5. Print Media

No, print media is not entirely dead. Some generations still use print media as a way to advertise directly to the market, avoiding relaters. Therefore, despite the internet, property in print media is still thriving.

Property magazines and newspapers with classified sections publish ‘gems’ of land deals can be developed so by subscribing to them both in print and digitally, you are likely to pick up a few pieces of land to view. Be sure to set your notifications and alerts for the type of land you are looking for in order to be one of the first to contact the buyer.

6. Site Agents (also known as Buyer’s Agent)

With Estate Agents and Development agents aplenty to offer you land for sale finding specialist site agents may be more tricky. The advantage of seeking out a site agent is that they will work with you exclusively to find your land at a relatively minimal fee; usually a percentage of the purchase price and because they are working on the commission they will often work harder than most in sourcing you the type of land you are looking for.

The biggest difference is that Site Agents are working for you, not for the vendor (landowner).

7. Local Government Sources

Public development land that is up for sale comes with some amazing perks. For starters, land must be advertised to everyone meaning that it cannot be sold out from under you. This, coupled with the fact that full transparency is enforced means that you don’t need to do too much homework or set yourself up for disappointment. Checking out your local municipal websites and contacting the development agents appointed will usually give you a great source of land potentially can be developed.

8. Your Consultants (e.g. Design Team)

If you are already working with a design team to promote your site and its future developments, then networking with them may be a good idea. Often, asking people who are within the market to assist you in finding land will yield good finds but be sure not to use this source too regularly or to please a friend consultant. You don’t want to have your design team too intermingled in the sourcing process.

9. Social Media

Yes, you read that correctly. Social media can be used to find land for site development. With LinkedIn and Facebook having dedicate pages designed specifically for property developers, you will find land for sale more often than not. The downside, of course, is that the internet isn’t always safe, so dot your I’s and cross your t’s and never hand over money without the proper paperwork in place.

10. Direct from the Owner

Going direct to the current landowner to put in an offer obviously comes with risks but by doing your homework and ensuring that you keep your deal above board you. Be sure to keep them interested though, and oftentimes they will go cold if you play your cards too openly.

Saying so, this is one of the best approaches to source land for developments.

Ones you find a property for development, before start negotiating the numbers or value of that property you must do your homework to identify how much really that deal is worth. This is where the Due Diligence and Feasibility Analysis got their roles.

Tip: Communication is the key to a successful negotiation when it’s come to finding a site. Online tools such as WhiteSmoke, Ginger, Pro Writing Aid and Grammarly can be useful in enhancing your written communication.

Due Diligence and Feasibility

It needs to be noted that residential land development takes time and enormous amounts of preparation before you can reap the rewards. For your development to take off with the least amount of hassle and setbacks, feasibility analysis and due diligence need to be done.

The Purpose of a Feasibility Study

No business should ever be launched without a proper business plan in place, and residential land development should be no different.

Without knowing what the pros and cons are for you and your business are, you will not have a starting point in knowing what exactly you hope to gain out of your business.

A feasibility study will set you on the right track in finding out if you

a) what level of success you can expect and

b) will help you breakdown any pitfalls before they raise their head.

When entering into residential land development knowing and planning for planning approvals, municipal regulations, community objections, budgetary constraints and possibly environmental factors is an absolute necessity.

The fact of the matter is that if a feasibility analysis isn’t done, and done thoroughly, you will never know whether your project will be successful. In other words, you will be making plans on dreams, good-will and hope, which is not really a business plan.

Feasibility Analysis, the Right Way

As your residential land development project progresses you will need to update and redo feasibility analysis, but while at the sourcing stage, you will need to find out what the feasibility of developing the site will be. This would be the first in a number of feasibility studies you will have done throughout the lifespan of your project.

What is a Feasibility Analysis or a Feasibility Study in Real Estate?

The formal definition of Feasibility Analysis is as follows;

“A real estate project is feasible when the property analyst come to the conclusion that there is a reasonable likelihood of satisfying specific property development objectives when a selected course of action is tested for fit to a context of specific constraints” – James A Graaskamp; A Rational Approach to Feasibility Analysis.

This, of course, means that feasibility analysis is more than thumb sucking figures based on what you think may or may not happen, and although you don’t want to waste too much time or money on your initial analysis, it should be detailed enough to, at a glance know at least the below.

– The initial cost of land

– Development approval potential and costs

– Operational works and associated costs

– Construction costs

– Titles, deeds and municipal costs

– Sales and cost of sales.

Without these being accurate, you will start your project on the back foot with adjustments needing to be done at a later feasibility analysis.

Due Diligence

Once you have short-listed or chosen a development site, you will need to do the necessary studies, including extensive research into the usage of your land.

Which type of residential development would work, what would need to be done to capitalize on the property you are interested in…etc. For this, you would need to contact your local municipality or local council to ensure that the seller actually owns the residential development site and once you know you are actually allowed to build (if purchased), then you can begin to evaluate what the value of your project will be.

Computer-based feasibility programs can now be used to put in the relevant estimates to get a more accurate reading of where your project will go as you move forward.

And of course, at this stage, you would need to bring in external consultants to assist you with due diligence and feasibility.

For example.

An Architect for the initial idea on what you envision for your project, size, design etc.

A Town Planner to understand development potential and possible challenges from your municipality or council.

Lawyers, or Attorneys who specialize in the property market.

A good marketing team to put together a proposal on marketing pricing and to understand the local demands and stability. (Don’t get confused with Affiliate Marketing though)

A Mortgage Broker or Financiers to explore potential challenges from banks with loan approval and confirmation of finance.

If it’s is your first development project, a company’s office for registration of your company, if it has not already been done.

Market Research

Doing an adequate amount of market research is a necessity to ensure that the project you are setting out to develop in actually required by residential buyers/tenants in the area your land is on.

For example, if your property is located in an area that is student dense, large three-bedroom townhouses are not going to have a larger market. Therefore, you should aim to develop a project (i.e. development plan) that fits correctly into your region, target market and their needs by identifying your market early on.

Real estate agents can be contacted to get a ballpark figure of what your residential development will sell for which gives you an estimated figure for further feasibility analysis, allowing you to know whether your project is going to yield the profit you are expecting.

Purchasing Your Site or Controlling Site Ownership

Ones, you are clear that the property you have looked into has a great potential as a development site, then you should look into a development feasibility analysis before committing to purchase it.

Tip: This is How Developers Raise Capital for Real Estate Developments.

Development Feasibility Analysis

A secondary feasibility analysis should be done at this stage, and during the process, you should look into the following variables

The purchase price of your land – this is the maximum you could pay for the property to get the project viable.

The equity to be sunk into the project from your side

Conveyance and attorney’s costs

Consultant and specialist costs – (architects, town planners etc.)

Construction costs

Rates and taxes which will be accumulated

Your unforeseen emergencies amount.

And finally, an estimated income from sales or rental of your development – this is the return on investment.

While your initial and secondary feasibility analysis is your working documents, by updating them as your project progresses, you are better able to stay in control of how your development is progressing. That also allows you to make changes where necessary before disaster strikes.

Be honest with yourself and ensure that you are pessimistic rather than realistic about what could or could not happen. This way, you are ensuring that you have planned for almost every eventuality.

By doing the correct research and driving a negative outcome rather than the best-case scenario, you are allowing your project the best opportunity at success, and although that sounds counter intuitive, a developer who continuously updates their feasibility analysis and is aware of every eventuality usually comes up tops.

If you are in the business to make money, which we know you are, then staying on top of what the market is doing, keeping your figures up to date and ensuring that you dot your I’s and cross your T’s is of utmost importance.

Ones, the secondary feasibility also adds-up well then you are certain that it is the development property you are after. In other words, you found a ‘gem’, and now it’s all about how to negotiate with the vendor (current owner) to purchase the property or somehow to control it for few months without purchasing it.

This is where Property Options agreements got its role.

Tip: Did you know that the Web Content Marketing is an excellent option to blog and earn money from home as a side income?

Property Option Agreements – Purchasing Your Site vs. Controlling Site Ownership

Property Option Agreements are put in place to allow the buyer (you) to buy or seller to sell their property on a pre-agreed price in the future. This is done to assist investors in managing their initial capital outlay and their tax liabilities.

Most investors are likely to be wary of developers who do or are not capable of putting their share of money down and while there is an abundance of reasons why a residential land developer may have limited funds making use of, and understanding how property options work can be critical to a low investment developer.

As with any investment, the risk is involved for both the developer and the landowner, because of this, all options and risks should be thoroughly investigated before entering into any property option agreement.

What is a Property Option?

In a nutshell, it is an agreement between the landowner and the developer (purchaser) which sets out the terms of profit sharing once development of the land is completed while paying a higher price on the initial land capital outlay.

When setting out the Property Option Agreement, the landowner usually agrees to allow the developer exclusive rights to purchase the land back at an agreed-upon price over a specific amount of time.

During the duration of the option agreement, neither party may buy or sell the land in question. In so doing the landowner ensures that the developer receives a slightly inflated price for their asset and time.

While most option agreements have a life span of 24 months, shorter or longer terms can usually be negotiated, allowing you the time you need to get necessary approvals before committing to purchasing ‘ideal piece’ of land for development.

The agreement, once drawn up, is secured with a deposit or an option fee to the developer.

The developer will then obtain a Development Approval from the municipality or council stating that they may improve the land over a certain amount of time. The advantage, of course to this is that the land is likely to appreciate in value once the Developing Approval is in place.

And, if your lawyer set the Option Agreement right, you should walk away if the development approval falls apart due to any unforeseen reason.

There are 3 types of Property Option types available.

Property Options Types

Call Option – Allows one party full rights to purchase the land at a predetermined price in a future date. In this case, the buyer is commonly not obliged to buy the property if they ever decided to not to buy in the future.

Put Option – Allows the seller the right to convince the buyer to repurchase the property at a predetermined future price.

Put and Call Option – A combination of the above, a put and call option allows the purchaser the right to buy or receive property at a predetermined price. In this case, the buyer is obliged to buy the property on the future date.

Why a Property Option?

For the real estate owner to know that their land is able to increase in value, ensuring a guaranteed sale at a later date at an inflated price is a massive advantage.

On the other hand, for you as a property developer to confidently know the property you are about to purchase is ‘developable’ before purchasing is also a huge advantage.

Accordingly, based on the above feasibilities you can negotiate a slightly higher than market value initial price is a massive positive, for you as well as for the seller.

But be cautious when approaching sellers as most will not agree to terms unless they are having difficulties selling their land and the reasons why will need to be investigated. Some simply by not being able to understand the complexity of an ‘Options Agreement’.

Pro’s and Cons of Property Option Agreements

A property option agreement for the property owner means that there is an opportunity to create profit and increase the value of the land. With flexible terms available to the landowner time can be bought effectively extending the time frame of the settlement of your property.

On the flip side, property option contracts are usually complicated and complex and require a fair amount of time to negotiate fair terms between parties. While most allow adequate time for the developer, not all sellers are prepared to allow the extra time needed to increase the value of the land adequately. This, coupled with the fact that option agreements are costly and can be risky due to the additional council hurdles and costs, time-draining promotion means that option agreement should not be entered into lightly.

Other Options to Finance Residential Land Development

Home loans are available to some land developers depending on the size or type of development you are planning. Some lending institutions will secure sites based on the land price, while others will offer their own set of terms and conditions.

Investigating the type of home loans available to you and what their benefits and downfalls are can assist low investment land developers in entering the market, particularly if they have an asset as some form of surety to cover at least a part of the home loan.

Ones you are certain about securing or controlling the property ownership, now the project begins formally with a certainty that it’s going ahead.

From this time onwards time is the essence, you should not waste a day because in the long run lost days’ means lost money.

The development process starts with seeking formal approval from your Local Authority or Council for a permit for your Property Development.

Local Authority and Council Permits for Property Development

Each council (or municipality) has its own set of regulations and laws which need to be followed in order for the development of land to occur.

The following three areas are fundamentals of developer’s guidelines regardless of your locality.

1. Planning

A planning permit allows the residential land developer to develop land or use the land for a specific purpose.

By approaching your local council office, you can get access to planning schemes and urban design guidelines that can be used within your area. Councils take under consideration and approve panning permits under the planning scheme.

Planning permits are binding, which means that once the permit is obtained, any changes will need to be documented and amendments will need to be made to the original permit.

However, it is important to note that some minor developments do not require a permit. Again, this can be clarified by talking to your local council.

Before the council grants a permit, they will allow surrounding property owners the right to object to any development on the land. This is usually done by advertising on their website or via print media. All objections need to be considered before they make their final decision.

2. Zoning

Land needs to be zoned to its particular use, and if the location is your property is not zoned as ‘residential’, then a residential zoning license will need to be obtained.

Guidelines and specifications are made available to developers under the council’s planning schemes and will advise the land developer whether a planning permit is required.

Zone information must be supplied when applying for a planning permit and usually come in three sections;

Land that does not require a planning permit,

land that requires a permit, and

Land prohibited uses.

Some land may fall into the prohibited for residential use category so be careful to check surrounding properties, vacant land and environmental reports before putting an offer in or purchasing the land. All these assessments should be a part of initial due diligence.

3. Overlays

Planning scheme maps will show whether the land has an overlay which affects the zoning.

Not all properties have overlays, but it is worth it to investigate the reason for the overlay; Heritage site, high flooding risk, environmentally protected etc.

Overlays will advise you of whether a planning permit is required to develop on the land and what the terms of such development would be.

For example, heritage sites will not allow the demolishing of an existing building.

A property with overlays usually takes longer to approve due to development objections or may significantly delay or increase building costs in order to accommodate the relevant restrictions.

Gaining local authority approvals will take time. For a simpler subdivision, the approval will take at least 4 months. The time is required for the below crucial tasks.

- Surveying the property

- Lodgment of the application to develop the property (at the Council)

- Designing the land division fulfilling the council’s guidelines and requirements (Architectural)

- Council’s review of plans

- Making necessary amendments to the plans

- Final approval for the development.

The beginning of the council’s development approval process is also the ideal time to plan and acquire finance for property deployment. This is how you fund the project, hence, known as project financing.

Project Financing

We have touched on home loans for certain types of residential land developments, but another property financing is available to residential land developers.

Property development loans are specifically designed to assist land developers in constructing multiple properties on a piece of land.

For residential land developers, residential property development loans are always an option if their plans consist of less than four blocks on the designated land. These blocks can, of course, be for duplexes or triplexes to maximize the future rental or selling potential.

Tip: This is How Developers Raise Capital for Real Estate Developments.

What is a property development loan?

A property development loan is a type of loan designed by the lenders to fund the multiple property constructions by a single real estate developer (borrower).

Residential property development loans are ideal for land divisions of up to four blocks, where units, duplexes, triplexes or townhouses will be built. However, if you’re planning on dividing the land to more than 4 blocks or building more than 4 houses, that is considered as a commercial project; hence, you will need to acquire funds through a commercial property development loan.

So, how do property development loans work?

Residential property development loans are formulated in almost the same format as residential construction loans, releasing the relevant amounts payable after each building stage is completed rather than a large upfront amount.

These amounts are released at deposit, base, frame, lock-up and fixing stages.

Anything leftover is then released once the project is completed. This means that builders’ are paid at completion of every stage of the project, encouraging them to work to the deadline.

Residential property development loan is low risk in comparison to their big brother, commercial development loans. The criteria are less strict, which means that if your business plan and feasibility analysis are correct, you are more likely to obtain one.

Features for residential property development loans include; up to 80% loaning on the value of the project, higher interest rates and contingency funding. It should be noted, however, that these types of loans only cover your hard costs such as labor, building materials, land etc. Soft costs such as land clearance, legal fees, marketing fees, architects fees and council approval fees will need to be covered by the investor (you or purchases of the subdivided blocks).

Tips for Applying for a Property Development Loan

Before applying for your loan, ensure that you know exactly how much you will need to borrow and how much the bank will be prepared to lend you. Compare the two amounts to ascertain whether you will be able to fund your project.

In your business plan, keep the reasons for the development clear and concise.

Will the properties be sold, rented, both? Will the property provide a residual income and if so, how much? For example, here are the Costs associated with Rental Properties when you Manage the property through a Property Manager.

And above all, be patient. Residential property development loans are a complex and involved process and can take much longer than a conventional home loan.

Your personal financial viability, as well as the viability, will come under scrutiny so be prepared to supply tons of paperwork and answer a plethora of questions.

The bank will need to assess their risk before approving the loan. This will be done by assessing your development plan.

Assessing Your Development Plan

The bank will need your comprehensive development plan and feasibility analysis including how much you will personally invest, whether you have a contingency fun, what your experience is within the development field, who you will be using to build your project and what their qualification is, zoning and location information and architectural design concepts…etc. before deciding your development loan application.

Record keeping is the key to win this process. Make sure that all your paperwork is in order, which will help the process move along quicker.

Ones you acquired the Council Approval and Property Development Loan, the rest is all on the ground to fulfill the requirements of the deployment approval.

Your contractors will play a role in this, while your role is daily monitoring and managing day-to-day hurdles of dealing with contractors.

Site Settlement

The nature of the land on which a residential land developer intends on building affects whether or not people will be prepared to settle in the new development. This means, if buyers will buy your developed land parcels or houses.

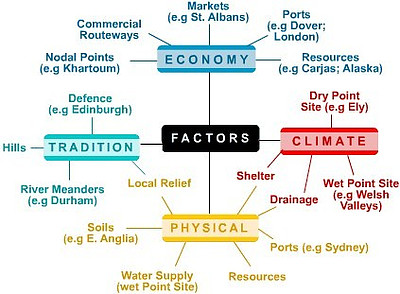

These include external man-made factors such as water and gas supply, ease of delivery of building materials, road and public transport access and position of the houses on the land. Natural external factors include soil type, bedrock and other unforeseen geographical or natural factors such as the water table or flood line. Generally, these can be broken up into Climatic, Economic, Physical and Traditional factors, all of which should be investigated prior to purchasing land. (at initial due diligence stage)

Illustration of site settlement factors

Site factors can both negatively and positively impact the ability to settle a site effectively. Some companies offer extensive specialized services that assist in the settlement of a project once it is complete.

Overlooking settlement is a common mistake developers make, and it is a costly one. Buyers need to be well-informed of every step of the process as the project is finalized in order for them to settle and begin generating income for from the investment immediately.

Tip: Here are the Best Real Estate Investment Strategies for Property Investors.

Off Plan Marketing

Off-plan marketing is the marketing of an off-plan property or a property that is available to buy before it has been completed or constructed.

Commonly, these refer to apartments but can be used effectively for duplexes, single unit or houses, and triplexes.

The off-plan property, when marketed correctly, can be incredibly lucrative to a developer because of the advantages it offers the potential buyer.

Generally, the buyer is able to purchase the property for a lower price than they would be able to pick up a completed apartment for, making it a great investment for resale. And, if the development is in a high demand area, the buyer has assured property in that area as soon as the project is complete. Usually, a deposit secures an off-plan property.

For the developer, off-plan marketing of a property is slightly riskier even if a deposit has been put down on an unfinished project. With many banks allowing off-site bonds on properties with the stipulation that the property is completed by a certain date, failing which, the offer would be retracted. This places a massive amount of pressure on developers. Having said that, the pro’s far outweigh the cons for off-plan marketing strategies, and if appropriately managed, off-plan can be very lucrative in settling a project.

Tip: Here is a Guide to Safer Start in Property Developments.

Tip: Did you know that some of the marketing tasks can be outsourced through Freelancer.com or Fiverr.com

get them done at a low cost?

Tip: You can even Set Up Websites for Free these days’ to market your land parcels or houses.

The Development – Dividing into Blocks

By this stage, you should do planning regulations and zoning, and it is the time for employing a land surveyor to come in and subdivide the land into new blocks as a priority now.

This is a part of the formal land division and offers invaluable advice on not only boundary lines but on-site settlement issues such as access to water, which house should be built first etc.

Aspects such as separate sewage and septic systems, water and gas line from central points, WiFi/internet access and ease of delivery of construction materials all need to be taken into account.

Registration for each unit based on the size of the subdivided block, the size of the land and the size of the building all need to be registered with the local council or municipality in order to comply with the relevant rates and taxes laws for each house now, not for the entire site.

Once the council has approved and endorsed the subdivision and the certificate of subdivision has been obtained, the surveyor can lodge the plan at the relevant authorities’ office on behalf of the land developer. When authorized the properties will be registered as single entities and ownership can be transferred to a new owner once construction is complete or an off-plan deal has been struck.

The Development – Building Construction

Finally, the building can begin if building houses by yourself is part of your plan (opposed to selling the blocks where the purchasers build themselves).

But first, you will need to pick a builder that fits within what you require. Choosing a builder who is going to fit within your plans, budget and time frame can be tricky and shouldn’t be rushed.

Take the time to go through several builders’ portfolio’s, paying attention to all aspects of their work, including finishes and guarantees on their work. Their building style should be in line with what your original vision is. Check their references thoroughly and stay away from the builders’ who cannot supply you with a referral for at least 75% of their projects.

Make sure that the contractor understands your budget and stays within in, obviously within reason. That is why you have a contingency budget and finally, ensure that they understand that time frame you are working with. Make sure that when references are checked that you ask about the capability of the contractor to complete a project on time. A meticulous builder who runs months behind on projects is not going to help a time-sensitive residential property development.

Settlement of Sale

Although many experienced residential property developers sell off-plan undeveloped properties or handle the selling of their properties privately, most will opt for real estate agents and conveyancers to handle the sale of their completed development.

The settlement of sale date is the day that all parties, financiers included complete their transactions. All documentation is exchanged, check and notarized, and all payments made. Once this is complete, the property is handed over to the new owner.

During this process, the conveyancer will communicate between the developer, the agent, legal entities and the buyer, usually at a fixed fee. Once all property is either sold or let the project is one hundred per cent complete, and the property developer can begin with a new project.

I like your advice that it takes at least four months to get approval for land divisions since there are so many tasks to do, such as surveying and council review of the plans. In order to ensure it’s done quickly and to help you get the best results, you’d probably want to ensure you hire the right professionals to work with for the surveying and other work. Researching local companies would probably be best so you can learn about their experience and services in order to determine which one can help you get the approval necessary to move forward with your land division plans.